Tere!

Since the 1st of July 2021, regulations about VAT on parcels to Estonia (or maybe I should say the EU) have changed. Before that, we didn’t have to declare and pay for VAT if a parcel’s value was under a certain amount. However, from the 1st of July 2021, we came to have to declare parcels from outside of the EU. (Yet, regulations for gifts from family members or friends are exceptional.)

In the latter half of July 2021, I strongly wanted to learn Swedish from the beginning in addition to Estonian. Then I looked for a Swedish learning textbook at Rahva Raamat (an Estonian book store chain), and found one book called “The Swedish Girl” (because I searched with the word “Swedish”). Reading the overview, it seemed to be a detective story which I like, so I searched for the same book on Amazon DE so that I could buy it more cheaply.

Then I found a second-hand book. The book itself cost only 4 euro, and the delivery fee was around 3 euro. I’m not sure if it was because of the COVID-19, but it said the book would arrive in a couple of weeks. (Considering the geography, the delivery is pretty slow.)

One day in August, I checked my mailbox which I hardly checked, I found two letters from Omniva (an Estonian postal company). One of them was delivered at the end of July, and the other one arrived at the beginning of August. (I thought both were the same contents though.)

Opening the letters, it was written in Estonian, but I roughly understood that

I had to declare the book that I bought on Amazon DE the other day.

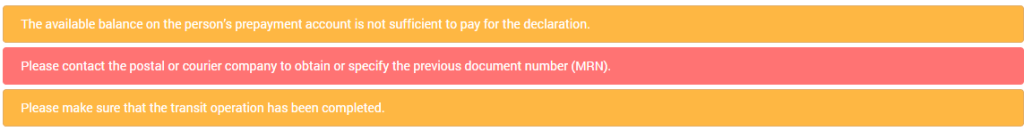

However, I still couldn’t believe it because the sender’s country was the UK. (I thought it should come from Germany as I ordered it on Amazon DE.)

Therefore, this time I’m talking about the declaration of the VAT on the book from the UK (or maybe I rather should say this is how to declare parcels).

Table of Contents

★How to Declare

1) Check the letter from Omniva

2) Access MTA

3) Log in EMTA

4) Specify the Parcel

5) Enter Items

6) Error Occured

7) Payment

8) Finishing

★Arrival of the Book

★In Case of Gifts

★How to Declare

1) Check the letter from Omniva

First of all, roughly check the contents of the letter from Omniva. There are two sections in the letter.

In fact there are two ways to declare: one is to do it on your own, and the other one is to ask Omniva to do it. The latter costs, so I did it by myself. (Later I noticed that the order of the sections seemed random.)

2) Access MTA

In my case section 1 had a link to access the MTA to know how to declare, so I did.

3) Log in EMTA

EMTA is an Estonian tax portal. In the page that I accessed above, it was written how to do it (briefly), so I followed.

4) Specifiy the Parcel

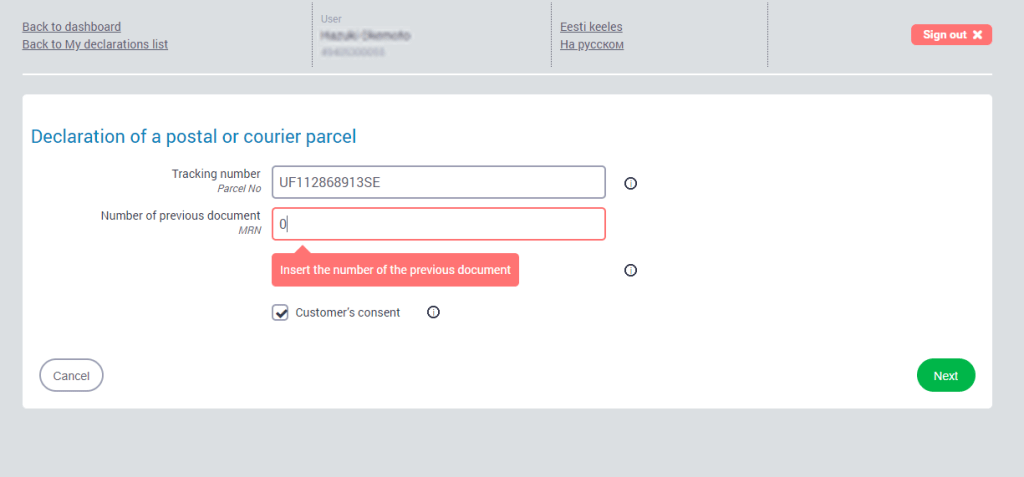

On EMTA, firstly, you need to specify the parcel that you are supposed to obtain. The tracking number is the one in the letter from Omniva, which starts ”Saadetise nr”.

Number of previous documents (MRN) is available from the link in the other section in the letter from Omniva. (At this point, I didn’t know what MRN was, so I randomly wrote “0”.)

5) Enter Items

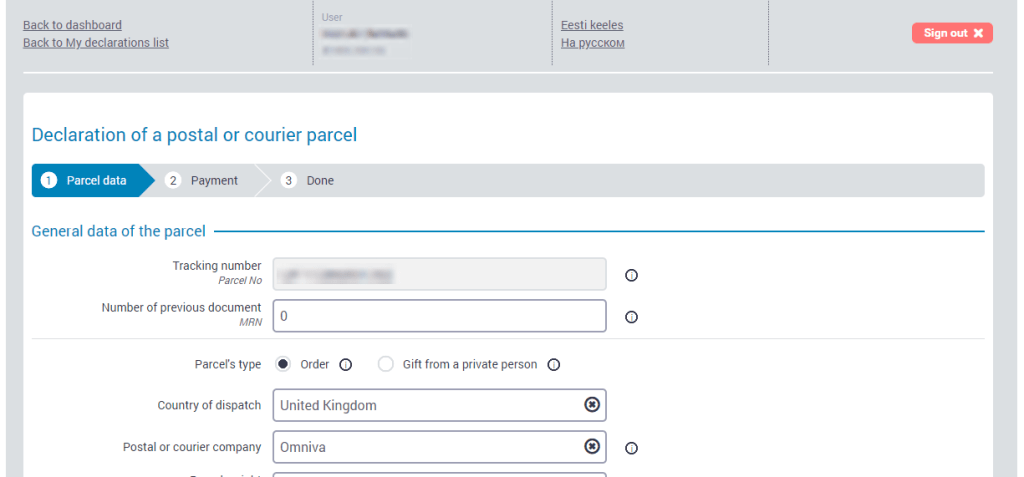

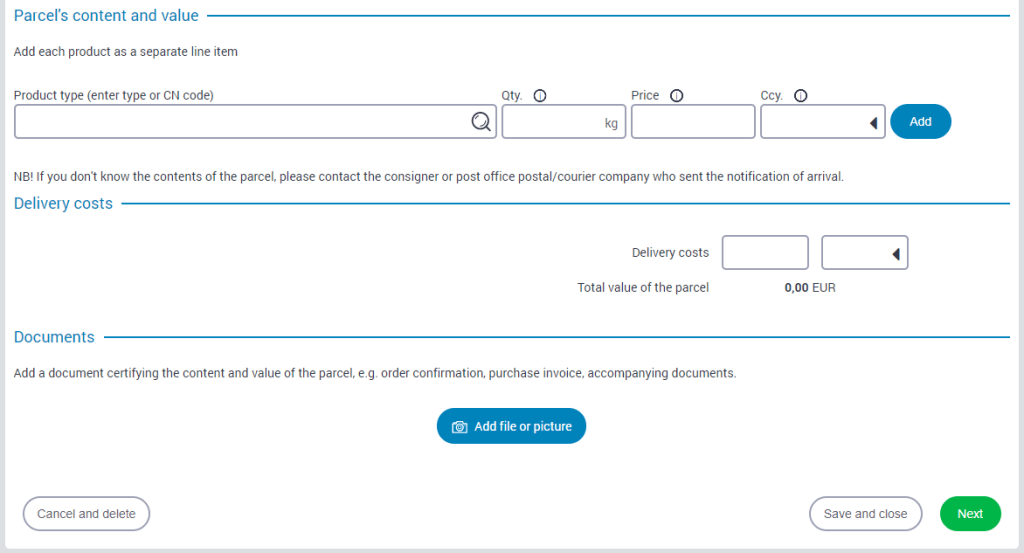

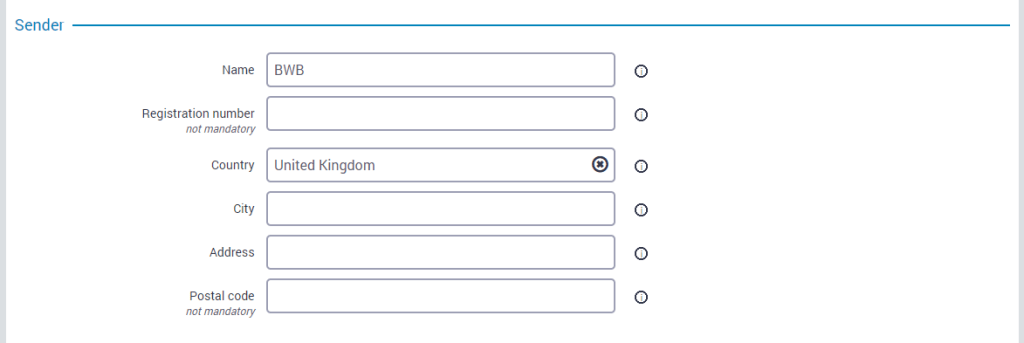

There are several items that you need to enter.

6) Error Occured

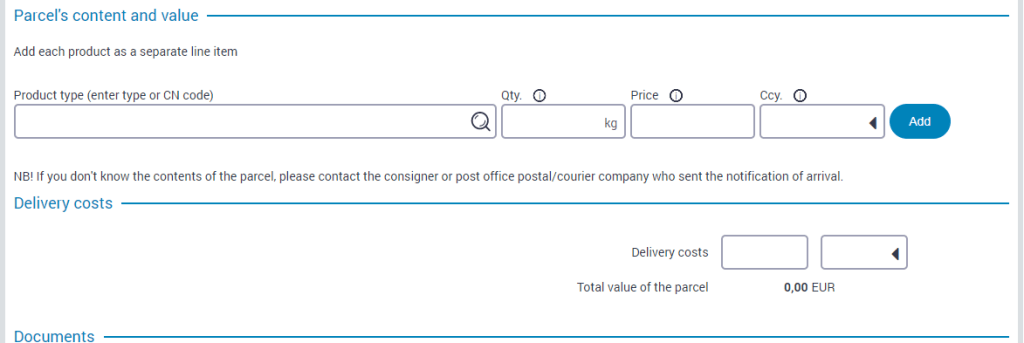

As mentioned, I thought the other link in the letter was the one to ask Omniva to declare, and I randomly wrote “0”, so I encountered an error. If you enter the information from the link in the letter, you can go next.

7) Payment

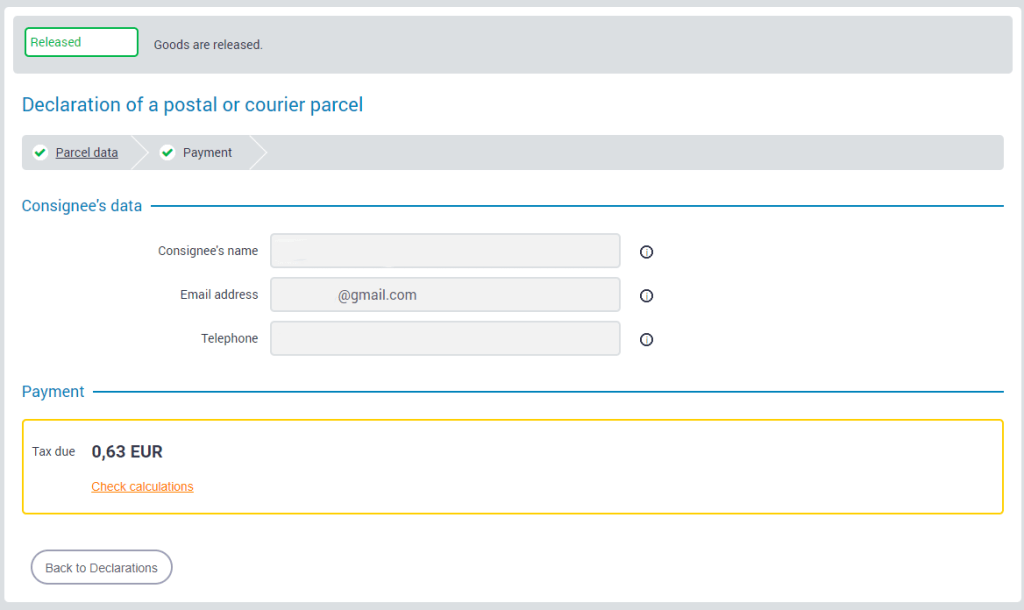

Once entering the items, you go to the payment page.

In my case I paid only 0.63 euro.

Considering the price of the book and the delivery fee, it was understandable, but I thought:

Do I really need to pay for such a small amount?

Anyway, without the payment, I wouldn’t have gotten the parcel so I paid.

8) Finishing

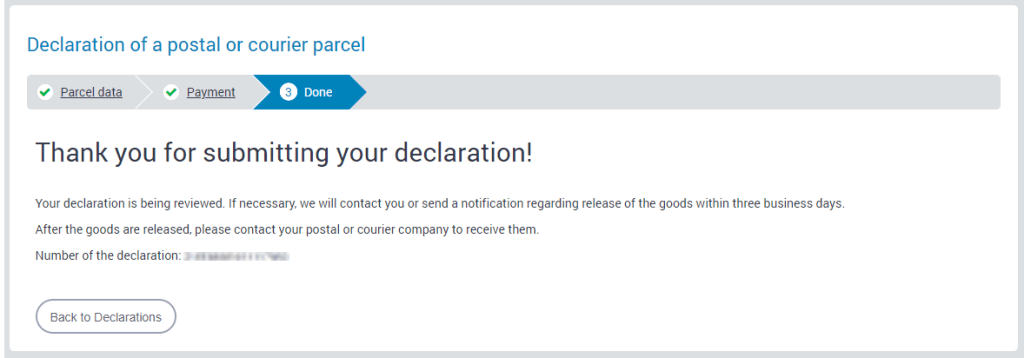

If you complete the declaration, the completion message will pop up.

All you need to do is to just wait for the parcel to arrive.

★Arrival of the Book

After several days, the book arrived.

It wasn’t a paperback but a hard-cover. I opened the book, and found something that it was used in the library.

I thought someone sold the book that they borrowed from the library, but I paid so I just started reading.

★In Case of Gifts

Also, after that, my friend in Japan sent me a super belated birthday gift, which value was less than 22 euro.

Therefore, I thought I could get like before, but the system had changed, and even though it was a gift, I still had to declare. (Omniva didn’t mention this at all!)

In terms of gifts, you would need the sender’s information, so when your family member or friends send you something, ask them to keep the receipts as well as other paper or digital information.

You may think:

But we can enter random information, can’t we?

You will need to upload proofs of the contents and their values. I didn’t know it either, and my friend already threw her receipt away too.

For this reason, she got the information online, and asked her to give me screenshots of that, and its (machine) translation.

I was still worried, but it went well. After that, I got a parcel from her.

So be careful when you get something from outside of the EU!

Aitäh! 🙂